In late 2020 we outlined a common yet powerful opportunity for businesses to secure rates in times of great volatility - forward contracting. At the time, the great interruption to the rhythm and routine of our industries and lifestyles brought about a dramatic drop in the average cost of wholesale energy. Fast forward two years, and we see a return to "business as usual" but compounded with the challenges of early power station closures, international conflict and extreme weather events, pushing the energy market in the opposite direction.

Forward contracting, however, does not rely on a bottomed-out market to remain an expert strategy in energy management, and is applicable today as it was in 2020.

What is Forward Contracting in energy terms?

In its simplest terms, forward contracting is the securing of an energy contract in advance that will come into play after your current agreement has concluded. Not only does this prevent you from returning to costly default rates, but also gives you the opportunity to form an agreement based on terms available now, in difference to a later date when the market has risen, for example during peak energy periods such as Summer. This is key, now, as we watch a dramatic rise in the average cost of wholesale electricity tear across the Eastern states, with no forecast of relief in sight.

Can it really make a difference?

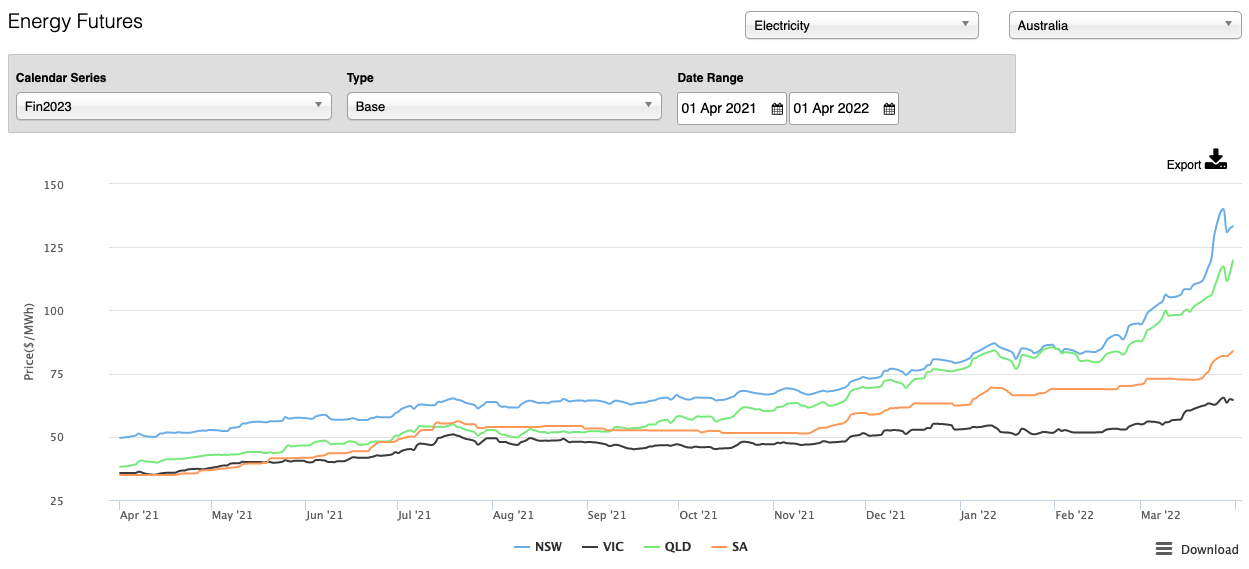

Each business is unique, especially when it comes to energy expenditure, and the art of forward contracting is comparing our current opportunities to our forecasted challenges. For example, let's say you are a manufacturer with heavy machinery, and your current contract ends March 2023. The rising costs of wholesale energy prices we can see in the graph above, plus the insights of your dedicated Choice Energy strategist suggest that the cost per megawatt/hour of energy today is likely to be significantly lower than it may be in January when your agreement finishes. By forward contracting today, we are able to leverage today's wholesale pricing to lock-in a far more favourable price than what we might see in March 2023.

And the differences can be incredibly dramatic. Had we done this with 21/22, we may have signed an agreement in May 2021 of $54 per mWh, against a Mid March price of $112 per mWh - Over a 50% increase in pricing!

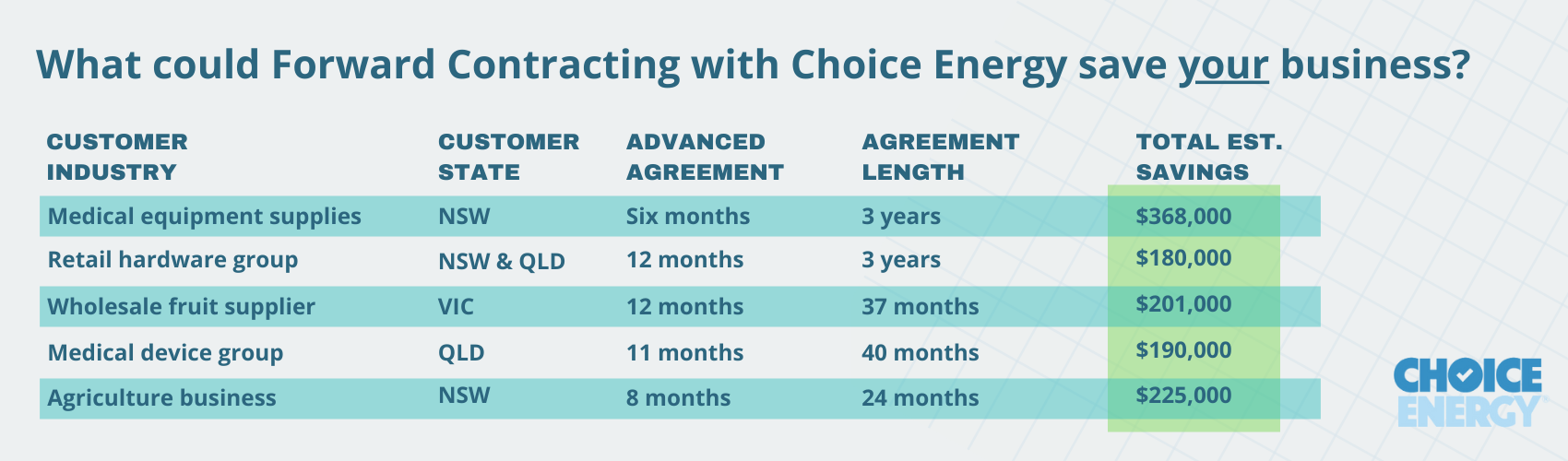

To really put this into dollars and cents, we've grabbed a few recent Forward Contracting examples, including their industries and how far in advance their new agreement sits, to give you an idea of how this can really add up.

How much can Forward Contracting actually save my business?

While we cannot accurately determine your opportunity sight unseen, our brokering service is a no obligation opportunity at no cost to you. That means we are able to investigate your opportunities to save and present them to you without you being obligated to make any changes. Instead, you can be sure it is the right option for you, with your dedicated broker able to guide you with no risk or cost. Reach out to us today on 1300 304 448 or contact us here to get the ball rolling.