SME Market energy update

Following the withdrawal of many energy suppliers from the SME market last year, more retailers have slowly returned during the first quarter of 2023, with some offering pricing as far as 5-10% below the National Default Offer or Victorian Default Offer.

This has been refreshing news for small business operators looking to secure a competitive energy plan for their business.

But with announcements made by the Australian Energy Regulator and Essential Services Commission in March re: default market offers coming into effect 2023-24, there is a significant concern amongst consumers and businesses and the impact of these changes on their energy bills.

Let us digest this for you.

Default Market Offer 2023-24 and its impact on small business in NSW, SEQ and SA

The Australian Energy Regulator (AER) released its draft determination of the Default Market Offer (DMO) for 2023–24 on 15 March.

Based on the announcement, it’s estimated small business customers could face price increases of around 14.7% to 25.4% depending on their region.

Although these price hikes are worrying, it's crucial to understand that the DMO isn't intended to offer a competitive energy rate, and there are still energy plans and discounts available that could be hundreds of dollars less expensive per year.

The DMO was created as a way to protect households and small business customers, on standard retail plans, from unacceptably high prices in South Australia, New South Wales and south-east Queensland. Essentially it is a price cap on how much energy retailers can charge electricity consumers on default plans, and helps consumers who don't or can't shop around for a new electricity deal.

The regulator will announce a final pricing determination in May that will take effect on July 1.

AER Chair Ms Clare Savage said:

“Energy prices are not immune from the significant challenges in the global economy right now; that’s why it’s more important than ever that we strike a balance in setting the DMO to protect consumers as well as allowing retailers to continue to recover their costs and innovate.

“We encourage consumers to shop around for the best electricity deal for your circumstances.”

As the energy landscape changes, we encourage you to continue to engage with Choice Energy to ensure you are on the most competitive rates for your business.

Victorian Default Offer and its impact on Victorian SME businesses:

The Essential Services Commission (ESC) also released its draft Victorian Default Offer(VDO) price review for 2023-24 on 15 March which will apply from 1 July 2023.

The announcement suggests small businesses in Victoria on default offers should anticipate electricity price increases of $1738 to $7358 per year, which is an increase of up to 33.2%. There are about 55,000 small businesses customers who are currently on the Victorian Default Offer.

The increases are being driven by last year’s sharp rises in the cost of wholesale electricity across the east-coast electricity grid.

According to the ESC, “The default offer is designed to be a simple, trusted and reasonably priced electricity option that safeguards customers that are unwilling or unable to engage in the market.”

Large-market energy update:

Gas market

“In December, the government introduced emergency laws capping the price of domestic gas at $12 a gigajoule for 12 months and domestic coal at $125 a tonne, reducing the cost of running power stations and cutting wholesale prices” (The Age).

This has created havoc for large-market gas users coming out of contract, with energy retailers not offering long-term large market gas agreements. As a result, many businesses are moving to default rates or spot pricing and paying as much as $39GJ.

In mid-March, the Australian Energy Regulator made a stark warning that Australia's southern states could experience further gas shortages during upcoming peak winter periods and ongoing shortfalls within only a few years. Read the article from the ABC here.

This makes it incredibly challenging for large businesses who require a lot of gas for their site.

As experts in the gas market we provide strategies on how businesses can navigate these challenges. We encourage you to reach out to Choice Energy to discuss your gas procurement needs. Get in touch now >

Electricity market

Below is our state-by-state breakdown for those on large-market electricity contracts.

Forward pricing options across the electricity market are looking more favourable for some states than others.

Table 1: Cal Base Future Prices as of 20 March 2023, Source ASX Energy

Victoria

Between October 22 and February 23, power prices fell between 30% - 50% and prices are expected to rise a further 20% during 2023 and 2024.

With competitive future prices available (See table 1, pricing for 2026 is 62.45), if you’re coming out of contract in the next 12 months, it's a great time to secure pricing now before further price rises occur.

Graph 1: VIC Cal Base Prices as of 20 March 2023, Source ASX Energy

New South Wales

If you are based in NSW and your electricity contract is ending June 2023, you will benefit from prices far better than five months ago (see graph below).

Graph 2: NSW Cal Base Prices as of 20 March 2023, Source ASX Energy

New South Wales also faces the closure of Liddell power plant in New South Wales, which is set to occur at the end of April.

While the closure has already been accounted for in current market pricing, it is unknown how the loss of a major power source could place pressure on prices and if this will be an upward direction as winter sets in. Read our blog on the closure here.

Adding further pain for New South Wales businesses - the Government has warned prices are expected to rise around 20% during 2023 and 2024.

Given all this, it’s worthwhile reviewing forward-contracting options if you are coming out of contract in the next 12 months, or exploring solar as a way to lower your business’s risk from rising energy costs.

Did you know, If solar stacks up for your business, you can pay the same amount or less for your electricity and simply use the savings that you are receiving by having solar to fund the system?

Queensland

Queensland electricity prices fell significantly between October and February with prices expected to rise this year and next year.

Graph 3: QLD Cal Base Prices as of 20 March 2023, Source ASX Energy

After CS Energy’s announcement early March that Callide won’t run at full capacity until January 2024, which currently meets roughly 30 percent of the state's electricity requirements, volatility was immediately seen across the spot market. It’s important to note, Queensland would be the hardest hit with supply issues, followed by New South Wales.

If you are coming out of contract in the next 12 months, it's a great time to lock in pricing for future periods of time before anticipated rises are set to occur.

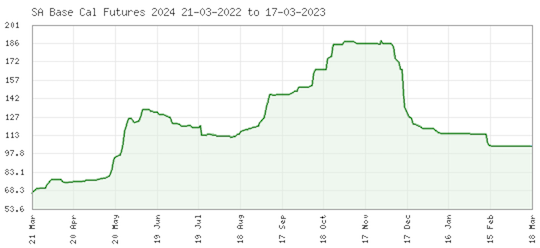

South Australia

While South Australia generates almost 70% of its electricity from renewable sources, it’s not immune to the challenges faced by other states across the National Electricity Market.

South Australia relies on 25 per cent of its maximum demand from electricity imported from Victoria (Energy Council), which means when challenges are experienced in Victoria these are often passed on to South Australian consumers.

South Australia saw a similar reprieve in pricing from the period of October to December as other states, but pricing is less competitive than it was 12 months ago.

Graph 4: SA Cal Base Prices as of 20 March 2023, Source ASX Energy

Despite this, with the market set to increase over the next few months, rates for 2023 have just dipped below 100 per MWh which is a compelling reason to review your energy contract now if it's set to expire this year.

A word of caution if your contract is expiring between now and 31 March 2024: we strongly encourage you to review your energy position with Choice Energy.

The Retailer Reliability Obligation is set to expire 31 March 2024. While you can wait until Q4, 2023 where pricing seems slightly more competitive than right now, there is a risk that by then there may be less retailer options available who have yet to meet their RDO confirmed cap, which could mean a smaller pool of retailer options to price against, or worse- none at all, which means the potential to fall on default rates.

Tasmania

Like many other states, Tasmania electricity prices fell significantly between October and February with prices expected to rise this year and next year.

As Tasmania is reliant on some power from the mainland, some have expressed concern about rises flowing onto Tasmanians including Tasmanian Labor's energy spokesman Dean Winter. But energy analyst Marc White expects there will only be a 5 to 15 per cent rise in Tasmania.

As the energy landscape changes, we encourage you to continue to engage with Choice Energy to ensure you are on the most competitive rates for your business.

If you’re coming out of contract in the next 12 months, it's a great time to review options around forward contracting before prices rise further.